Stne Stock Forecast Tipranks

If an investor was to purchase shares of stne stock at the current price. Investors bloggers insiders news hedge funds.

Based on 8 wall street analysts offering 12 month price targets for scorpio tankers in the last 3 months.

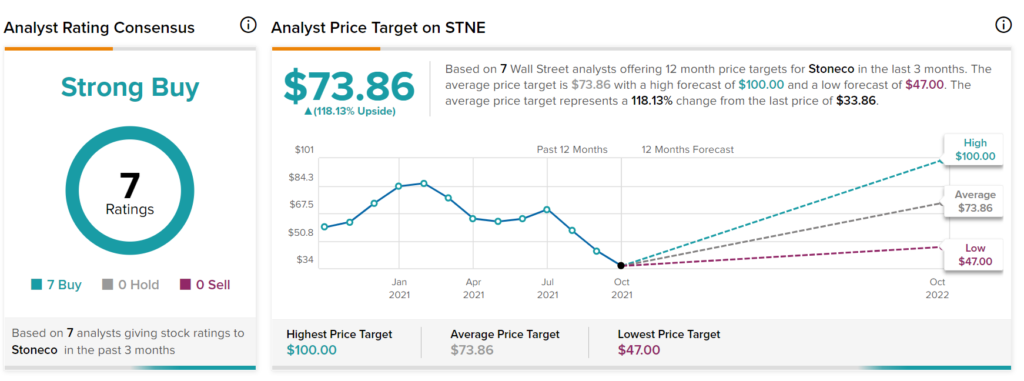

Stne stock forecast tipranks. Shares of the brazilian fintech company stoneco (nasdaq: The average price target represents a. Despite this impressive topline growth, the stock is down over 80% since the february peak near $95.

There it ranks in the 10th percentile. Get prepared with the key expectations. (stne) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report.

At stne's current market cap of $21.1b, a forward. Et on motley fool stoneco ltd. The stoneco stock analysis is based on the tipranks smart score which is derived from 8 unique data sets including analyst recommendations, crowd wisdom, hedge fund activity, media sentiment and multiple technical stock factors.

Turning to the calls side of the option chain, the call contract at the $17.00 strike price has a current bid of $1.25. Banco santander's target price points to a potential upside. If an investor was to purchase shares of stne stock at the current price.

The revenue is good, growth is good and the market is blue sky for company to grow. The average price target is $21.88 with a high forecast of $30.00 and a low forecast of $13.00. The average snap stock price prediction forecasts a potential downside of n/a from the current snap share price of $47.91.

Analyst price target on stng. Stoneco stock opened at $19.13 on friday. It was in $90s few months back and now at $37!

(nasdaq:stne) shareholders will have a reason to smile today, with the analysts making substantial upgrades to next year's statutory. Pomerantz llp is investigating claims on behalf of investors of stoneco. The price/operating cash flow metric for stoneco ltd is higher than merely 4.68% of stocks in our set with a positive cash flow.

And after last week's report, shares dropped over 40% on massive volume of 87 million shares. Stne ranks lowest in sentiment; Such investors are advised to.

Stne) plummeted more than 36% this week, as of market close thursday, after stoneco reported earnings results for. $1.2 (2.38%) stock analysis analysts risk factors. Lastly, the stock's forward p/e of 70 is not realistic in the first place, implying a substantial earnings growth deceleration.

They currently have a $17.00 price objective on the stock. The company has a 50 day moving average price of $34.33 and a 200 day moving average price of $50.57. Stoneco (nasdaq:stne) was downgraded by analysts at banco santander to a sell rating in a report released on tuesday, tipranks reports.

16, 2021 at 6:54 p.m. Turning to the calls side of the option chain, the call contract at the $20.00 strike price has a current bid of $4.40. Yes, credit card business is hit but isn’t that an opportunity for us to buy and hold?

(stoneco. or the company) (nasdaq: One thing we could say about the analysts on stoneco ltd. Stoneco has a 52 week low of $19.07 and a 52 week high of $95.12.

The firm has a market capitalization. (stne) reports q3 loss, tops revenue estimates

Komentar

Posting Komentar