Irctc Stock Price Analysis

We should take a buy entry at 4210. In short, stock split is ‘no gain no loss’.

| bse 812.15 17.80 (2.24%) | nse 811.95 16.80 (2.11%) | trade | add.

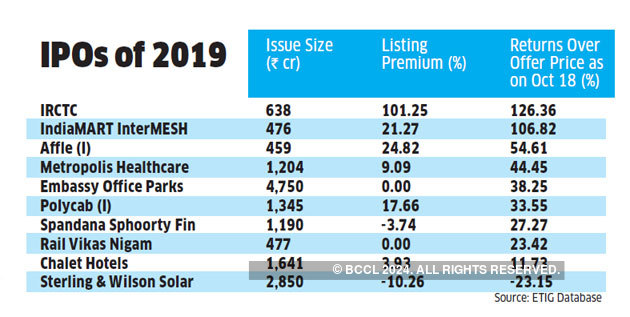

Irctc stock price analysis. The ipo of irctc was open for subscription between september 30, 2019 to october 4, 2019. Volume based technical analysis of indian rail irctc stock is negative. So it is sitting somewhere in between the low and high.

Hello, this is my technical analysis for indian railway catering and tourism corporation ( irctc ) stock. The consensus estimate represents an upside of 7.16% from the last price of 823.05. 5.29, market cap of irctc is rs.

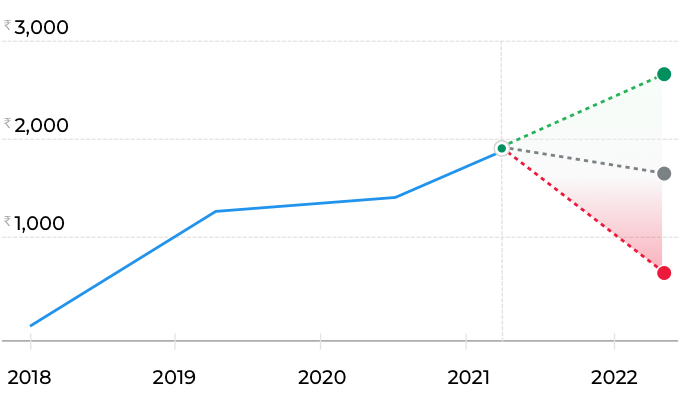

Has an average target of 882.00. Indian railway catering & tourism corporation limited stock forecast, predictions, and share price target for 2021, 2022 (1 year) to 2025, 2026 (5 year) to 2030, and 2031 (10 year) with revenue and eps prognosis by technical analysis. But on the day of listing, the opening price of the share price was 624.

Critical is the fibonacci level at 823, the breaking of which the stock should find a resistance at 803. If you look at the current price of irctc it is trading at the level of above 4000 and if you look at the lows and high, the low was 1300 and the high was 6200. Ad unparalleled coverage & analytic comparison.

According to my analysis the price will go up. We should take a buy entry at 4210 the target should be at 4390 stop loss at 4088 note: Stock has now been splited and now it is trading on higher side and it can move beyond rs 1200 in a short span.

Markets india stocks consumer services other consumer services irctc. Try our software for free today. What are the key metrics to analyse irctc share price?

Irctc share price target is rs 8200 (1400 after split) within a year as per stock momentum and chart analysis. The target should be at 4390. This is just a technical analysis (it doesn't guarantee that the analysis will always be the correct) if by any chance we.

Check irctc share price, financial data and complete stock analysis.get irctc stock rating based on quarterly result, profit and loss account, balance sheet,. Hello, this is my technical analysis for indian railway catering and tourism corporation (irctc) stock. The stock price also gets adjusted.

Stock analysis of indian railway catering tourism corp (irctc) with birds eye view on its returns, highs/lows, technicals, fundamentals & future & option, stock strength, charts. According to my analysis the price will go up. Volume weighted averaged price (vwap) for short term is 823.54 and indian rail irctc stock is trading below this level.

Pe ratio of irctc share is 163.71, earnings per share of irctc is rs. The shares were listed on both the stock exchange, nse and bse on october 14, 2019. Find the latest indian rail tour corp ltd (irctc.ns) stock quote, history, news and other vital information to help you with your stock trading and investing.

Try our software for free today. View 7 reports from 3 analysts offering long term price targets for indian railway catering & tourism corporation ltd. Below which another support is at 777.

Irctc has breached the trendline at 866 and 50 day ema at 826. This means that stock is falling with high volumes. From ai system, total return is 3106.83% from 2918 forecasts.

If the price was ₹ 100 yesterday, after the 1:5 stock split it would reduce to ₹ 20. 69,000 cr and price to book ratio of irctc stock is 47.04. Irctc is fundamentally strong stock and it should be hold for longer term for multibagger returns.

Highlights & chart patterns of indian railway catering &. Key metrics is a good way to quickly analyze a stock. Which was oversubscribed at a price band of rs.

Ad unparalleled coverage & analytic comparison. Indian railway catering & tourism corporation ltd. People seem to be coming out and selling the indian rail irctc stock.

Komentar

Posting Komentar