Cumulative Preferred Stockholders Have The Right To Receive

A)must receive dividends every year. Subject to any preferential rights of any outstanding preferred stock, holders of our common stock are entitled to receive ratably the dividends, if any, as.

Stockholders have no rights to dividend for years in which none were declared.

Cumulative preferred stockholders have the right to receive. Cumulative preferred stock can receive the dividend even before the stockholders receive their payment. A) the right to purchase additional shares in direct proportion to their number of owned shares b) the right to elect the board of directors c) cumulative voting privileges over the preference stockholders d) the opportunity to receive extraordinary earnings Par value is an arbitrary, meaningless value assigned to stock by the issuing corporation.

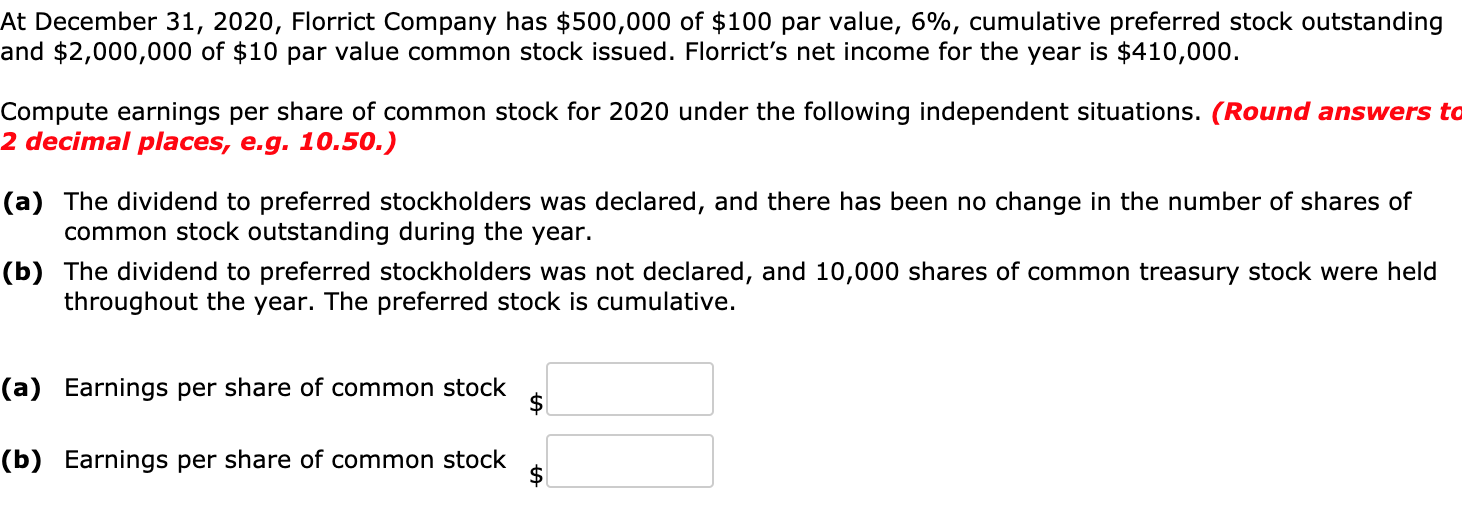

Non cumulative preferred stock does not have this right arrears cumulative preferred stock dividends that have not been paid in prior years. $250,000 ( 0.07 = $17,500.) thus, the entire $16,500 was paid to preferred stockholders. D)must receive more dividends per share than the common stockholders.

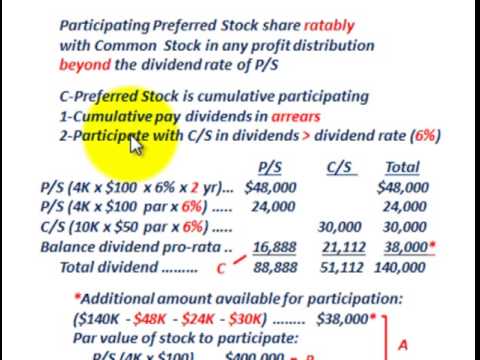

As the name implies, the preferred stockholders have a preferential right or claim to. A participating feature gives preferred shareholders the right to receive a share of dividends paid to common shareholders. Holder of our common stock are entitled to one vote for each share on all matters to be voted upon by the stockholders and there are no cumulative rights.

Has a right to receive regular dividends that were not declared (paid) in prior years. Discount the interest deducted from the maturity value of a note. Share of the stock is a financial instrument that indicates ownership of the stockholder in the company which states that the stockholder has a claim in the profits and the assets of the company.

Cumulative preferred stocks allow the accumulation of dividends until they are paid. Must receive dividends every year. The stock that pays a fixed amount to its holder ahead of any payment to common stockholders is known as preferred stock.

Capital 6 legal 7 cumulative feature 8. Certain purchase privileges of additional stock shares in direct proportion based on their number of owned shares. Because cumulative preferred stock had been issued, the preferred stockholders have the right to receive $17,500 in dividends before common stockholders receive payment.

B)have the right to receive dividends only in the years the board of directors declares dividends. The cumulative preferred stock shareholders must be paid the $900 in arrears in addition to the current dividend of $600. All dividends in arrears must be paid before any dividends are granted to.

C)have the right to receive dividends only if there are enough dividends to pay the common stockholders too. Because cumulative preference shareholders are entitled to receive dividends on a regular basis, including earlier payouts that were missed, the corporation would have to settle all unpaid dividends (i.e. A) have the right to receive dividends only in the years the board of directors declares dividends.

Noncumulative preferred stock has right to receive preference dividend each year before any dividend can be paid on common stock. Stock rights provide the stockholder with. It provides a right to claim dividends of the specific amount which would be received each year.

Must receive more dividends per share than the common stockholders. The opportunity to receive extraordinary earnings. If preferred stock is designated as cumulative, the suspended dividends accumulate, and you must later pay them in full.

Have the right to receive dividends only in the years the board of directors declares dividends. The right to elect the board of directors. Have the right to receive dividends only if there are enough dividends to pay the common stockholders too.

This means that the company is supposed to pay all the dividends, including the ones that were previously not paid out, to these cumulative preferred shareholders. Preferred stockholders typically receive the right to preferential treatment regarding dividends, in exchange for the right to share in earnings in excess of issued dividend amounts. (25,000 shares ( $10 par = $250,000;

The inr 60 per share dividend arrears) before paying the inr 20. O preferred stock dividends may be cumulative, meaning that the rights to receive undeclared dividends accumulate “in arrears” until the next time the board declares a dividend. Once all cumulative shareholders receive the $1,500 due per share, the.

Then the preferred shareholders receive up to the total of the dividends in arrears plus the current period’s Stock that has a right to receive regular dividends that were not declared (paid) in prior years. B) have the right to receive dividends only if there are enough dividends to pay common stockholders too c) must receive more dividends per share than the common stockholders d) must receive dividends every year

Cumulative preferred stocks are a type of preferred stock that abides the company to pay all the dividends for this type of shareholders before paying any other shareholder of the company.

Komentar

Posting Komentar