Am Stock Dividend Safe

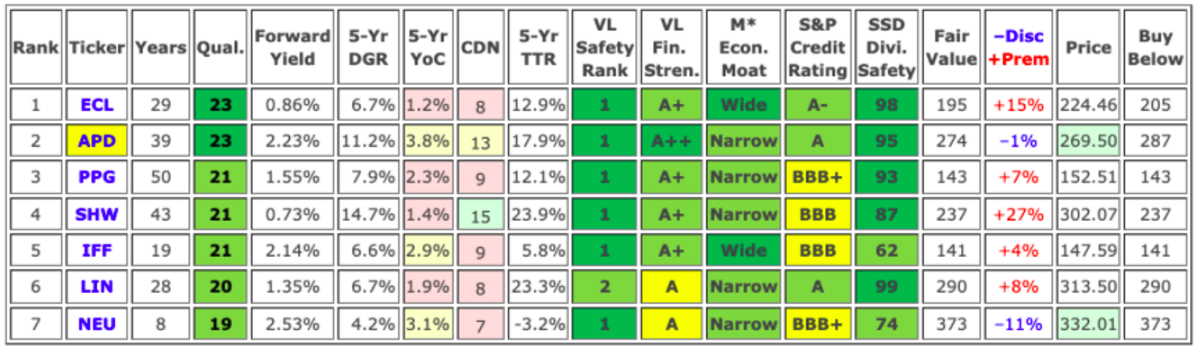

These dividend stocks appear to be safe picks for 2019. A stock deemed safe by the company can score from 61 to 80;

Antero midstream corp dividend stock news and updates.

Am stock dividend safe. After a quick setup, you'll be treated with a big picture view of all your accounts and detailed data on each holding — all updated in near realtime, all tailored for the needs of a dividend investor, and all at your fingertips with pinpoint accuracy. Written by marc lichtenfeld wednesday, december 9, 2020. On a free cash flow (fcf) basis, verizon has a dividend payout ratio of 43%.

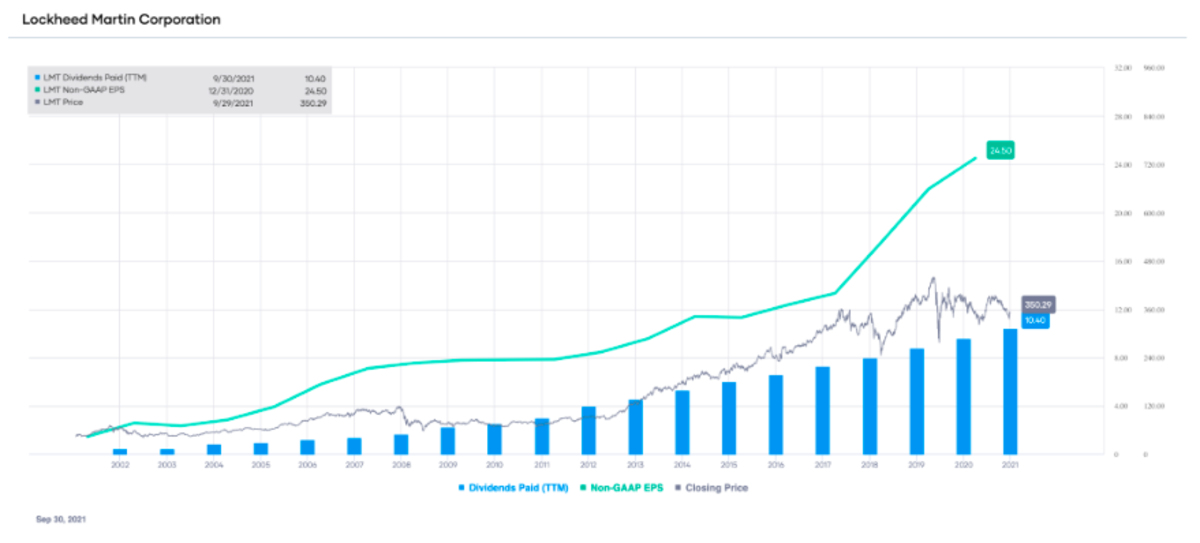

Quality dividend stocks can serve as a foundational component of current income and total return for a retirement portfolio. +0.19 (+1.79%) closed at 4:00 pm et on nov 05, 2021. This month, we highlight three groups of five stocks each that have an average dividend yield (as a group) of 3.48%, 5.58%, and 6.73%, respectively.

When yields get above the. 128.57% based on this year's estimates. This percentage is based on an operating cash flow (ocf) of $41,768 million in 2020 and capital expenditures of $18,192 million.

Suntrust has a 3.6 percent dividend yield and a 29.2 percent payout ratio. This page was last updated on 12/6/2021 by marketbeat.com staff. It’s difficult to analyze the dividend safety of this.

Cfra has a strong buy rating and $79 price target for sti stock. +0.33 (+3.31%) closed at 4:00 pm et on jun 21, 2021. 70.86% based on cash flow.

While they wait for the recovery, investors can enjoy the stock’s relatively safe 5.3% dividend. Morningstar has a “buy” rating and $82 fair value estimate for dfs stock. In late july, the company declared a quarterly dividend of $0.365 per share, an increase of 9% from the previous dividend of $0.335 per share.

It is among the top safe dividend stocks to invest in with a dividend yield of 3.1%. 100.00% (trailing 12 months of earnings) 120.00% (based on this year’s estimates) 105.88% (based on next year’s estimates) 66.96% (based on cash flow) am dividend frequency: Even before the issues facing oil companies were magnified by the opec supply shock,.

(nasdaq:wabc) had an eps of $0.82 in. For very safe, it’s 81 to 99. Antero midstream corporation common stock (am) nasdaq listed.

Among investors, antero midstream (nyse: Connect your brokerage account, import a spreadsheet, or type in your holdings to track your dividend income, dividend safety, diversification, and more. 130.43% based on the trailing year of earnings.

Data is currently not available. The first list is for conservative investors. Dividing the annual dividend/distribution by the existing stock/unit price gives you the dividend yield.

Barron’s additionally searched for companies that have grown their dividends for at least five years, again based on data from simply safe dividends. In addition to water utility, the firm also has. With the help of simply safe dividends, which publishes a newsletter and website dedicated to equity income investing, we started with a dividend yield of 3% to 4.5%.

Am) is a relatively unknown gas pipeline company servicing pennsylvania, ohio and west virginia. Antero midstream corporation (am) dividend safety metrics, payout ratio calculation and chart. Having a 47% dividend coverage with a dividend yield of over 4.0% is very safe.

111.11% based on next year's estimates. Look to see how quickly the dividend. The dividend payout ratio for am is:

It has not yet cut its dividend, implying that it may as yet be safe.

Komentar

Posting Komentar