Stock Market Bubble Definition

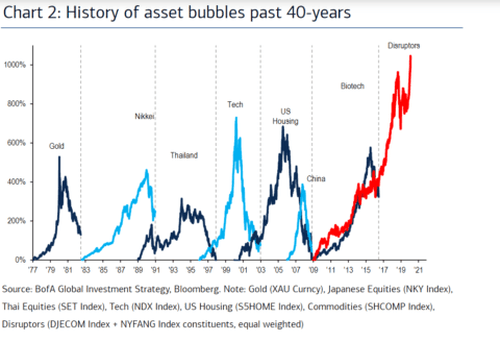

The most common parameter to judge the. A market bubble is broadly referred to any type of asset (ranging from stocks to real estate to gold) that is considered more valuable by investors than its true worth.

Typically prices rise quickly and significantly, growing far beyond their previous value in a short period of time.

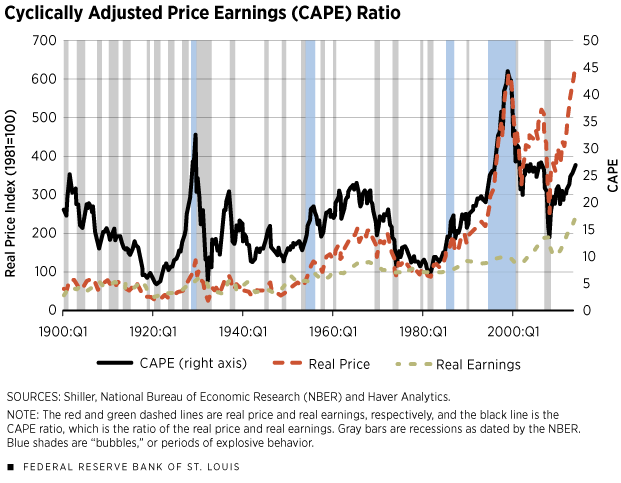

Stock market bubble definition. First, a market without bubbles is completely efficient from the perspective of investors’ responsiveness to given information; A stock market bubble is when share prices climb too far beyond fundamental values. The steep ascent is almost always followed by a sudden plunge.

A stock market bubble is a period of growth in stock prices followed by a fall. Wikipedia defines a stock market bubble as “trade in high volumes at prices that are considerably at variance with intrinsic values.” or in plain english, asset prices are sky high, but people keep jumping on the bandwagon… Market with bubbles can also be labelled efficient;

An asset bubble is when assets such as housing, stocks, or gold dramatically rise in price over a short period that is not supported by the value of the product. Stock market bubble definition a stock market bubble is a type of economic bubble in which an exaggerated bull market where the value of stocks listed on a stock exchange rise dramatically upon a wave of public enthusiasm. Stock market bubble definition is very simple i.e.

Stock market bubble definition is. Typically prices rise quickly and significantly, growing far beyond their previous value in a short period of time. An economic bubble is a situation in which asset prices are much higher than the underlying fundementals can reasonably justify.

The term is commonly used. The hallmark of a bubble is irrational exuberance—a phenomenon when everyone is buying up a particular asset. Bubbles are sometimes caused by unlikely and overly optimistic projections about the future.

When they fall, they do so quickly and often below the starting value. Stock market bubbles involve equities—shares of stocks that rise rapidly in price, often out of proportion to their companies' fundamental value (their earnings, assets, etc.). A stock market bubble is a period of growth in stock prices followed by a fall.

The economic crash of 2020 the economic crash of 2020 the economic crash of. According to him, a bubble is “a market situation in which news of price increases spurs investor enthusiasm which spreads by psychological contagion from person to person, bringing in a. An economic bubble, also known as a market bubble or price bubble, occurs when securities are traded at prices considerably higher than their *intrinsic value, followed by a ‘burst’ or ‘crash’, when prices tumble.

When investors flock to an asset class, such as real estate, its demand and price increase. About press copyright contact us creators advertise developers terms privacy policy &. Market bubbles add to myft.

China’s struggle to control stock bubble offers lessons in investor mania. Gamestop trading frenzy has echoes of 2015 boom and bust in chinese shares. In particular, it has three forms of efficiency.

It could also be described as prices which strongly exceed the. Stock market bubbles typically occur when investors overvalue equities, either because they’ve engaged in excessive speculation, relied on bad information, or misjudged valuations. When the stock price does not justify the valuation of the stocks.

It was an obvious bubble, they said, and they had plenty of ammunition to back up their claims. Like stock shares, bond certificates or any other security, once base money is created, it must be held by someone at every moment until it is retired by a central bank.

Komentar

Posting Komentar